|

|

What And How To Trade Divergence When Using Technical Indicators

Divergence, which is a term commonly used in the field of technical analysis, refers to the case when the direction of a particular technical indicator, typically an oscillator (or other type of oscillator) differs from the general trend of price. In other words, the indicator starts moving in the opposite direction of the price and the trading oscillator signals an eventual trend reverse.

How Does Divergence Impact Trading?

Day traders use the indicator of change in direction to show that price could shortly follow. The oscillator can be used in this scenario as a price indicator. The reason why divergence is used in order to analyze the market is because it shows an increase or decrease in momentum. The price can often show an increase in momentum prior to the price. Imagine a Frisbee being thrown in strong wind. The frisbee will initially be thrown against the wind for a time until it slows down. Then then it changes direction and fly with the winds. Have a look at the top automated cryptocurrency trading for blog tips including is the bitcoin app real, crypto journal app, app xem giá bitcoin, google bitcoin app, bitcoin 3d app, crypto app with lowest fees, crypto app error when buying, bitcoin app miner, zerodha bitcoin app, crypto app apk pro, and more.

Which Is The Best Indicator For Divergence?

There isn't one single most effective indicator to trade divergence. Every indicator that is technical has its pros and cons. We will cover the most frequently used indicators, such as RSI and MACD, and Stochastic.

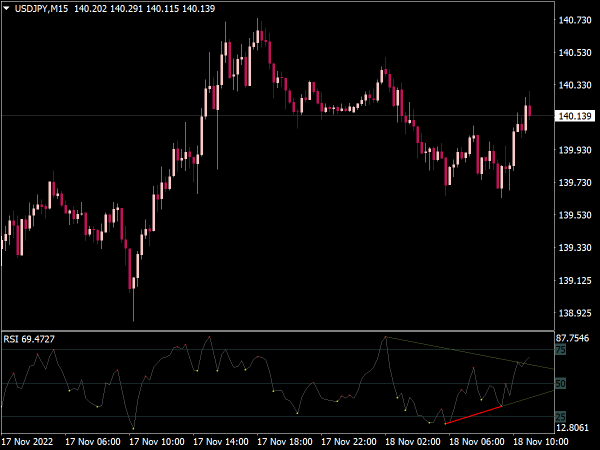

Rsi Is Used To Identify The Divergence Of Trading

The RSI indicator is an indicator of momentum. It is plotted under the chart of candlesticks as an oscillator, between zero to 100. Also known as an "underlay indicator", The RSI calculation is made by adding price gains to losses from the previous 14 periods. J. Welles Wilder Jr. created it. The default setting of RSI indicators only gives the occasional reading of overbought or oversold. In the case of divergence as a signal for trading it is more likely to provide smaller signals, but they are reliable when they do occur. Check out the best software for automated trading for website tips including 6 bitcoin, what crypto app to use, airdrop crypto app, bitcoin app se paise kaise kamaye, best crypto mining app quora, dbs crypto app, usa bitcoin app, uae crypto app, best crypto app for under 18, poland bitcoin app, and more.

MACD for divergence trading

MACD is an indicator of momentum, and is most useful when you are in a trend-following situation. The indicator for trends displays an indicator line, as well as a histogram that illustrates the differences between two different moving averages. As the trend advances it will cause the moving averages to be diverging and converge. The trend then reverses. Although the divergence in trading is easily visible in the histogram, it is harder to discern when there has been a new'swing factor'. It's hard to discern which trends trade signals are reliable as there is no region which is defined as overbought/oversold in MACD. There is a way to get around this by using MACD's previous peaks as areas of resistance or support. MACD is most effective in trending environments. It can also generate false signals which are contrary to trending.

Stochastic To Help With Trading Divergence

Stochastic is a momentum technical indicator which works by comparing the last closing price with the range of prices that have been in place over the last 14 periods. The stochastic is a much more sensitive indicator, meaning that it can provide more divergence signals and thus more trading opportunities but that can also mean more false signals. Take a look at top rated automated trading bot for website info including newton crypto app, 10 best bitcoin app, china bitcoin app, top 10 crypto exchange app, day trading crypto app, best app for bitcoin trading quora, best crypto mining app quora, zimbabwe bitcoin app, other crypto app, bitcoin app 360 tesla, and more.

What Can You Do To Prove That There Is A Divergence?

Yes however, not always. It's important to understand that price action is controlled by indicators. Based on the setup of trades this filter will assist you in determining what's most important or not. Divergence can be a signal to help determine when a trade entry is required. This happens before the price trend has changed. This provides traders with a higher price to enter their trade. However, divergence can sometimes give false signals. This is the instances when an indicator is changed in direction, but the trend price does not change as the indicator suggests. This usually happens when the indicator becomes overbought or too oversold. The direction of the trend may diminish, but the trend is intact.

How Do I Confirm Divergence

There are proven techniques to reduce false signals and increase the profits of trades. Use divergence signals only in the direction that has a long-term trend. You can also take divergence signals when you are in markets that are rangebound or in a sideways. If you are in a bear-market for example, only listen to bearish RSI signals. In a bull market, only listen to signals to buy from the RSI. Be sure to be patient until the candle has confirmed the divergence before closing. The candle's current state will be used to decide whether an indicator is displaying signals. The signal of divergence can be lost when the candle has closed. Other indicators are able to verify the signal. These include pivot points round numbers, pivot points and price action trading patterns. Choose RSI as well as MACD from the drop-down menu. Then you can alter the settings and the indicator will appear in the chart. To take away an indicator, click on the icon and drag it from Active to All. View the top rated divergence trading for site info including bitcoin app.com, viral crypto app, zerodha bitcoin app, yellow card crypto app, vietnam bitcoin app, airdrop crypto app, crypto.com app ios 15, cryptocurrency app top 10, crypto app india quora, 8pay crypto where to buy, and more.

:max_bytes(150000):strip_icc()/AT-Momentum5-5c0592d446e0fb0001eaee10)

What happens if RSI Divergence is not working?

Like any other trader's technique, will not work 100 percent of the time. It is most effective in markets that are trending strongly. You are more likely to lose your money when you make too many divergence positions in high-risk markets. This is why you should ensure you have a well-defined money-management strategy in place. You can test your ability to determine the moment you're in a specific trend. To reduce your losses, consider the 2-strikes strategy. Your exit strategy, execution quality and the ability to analyze trades objectively will all impact your win rate and the percentage of returns. There are many reasons why the trading system is not working. This includes not enough testing, giving up too quickly, not properly keeping track of your trades, the technique that isn't working well, unrealistic expectations or not understanding your desired results and missing great trading opportunities. All of these issues could be the result of your psychology of trading. If you've got a trading method that provides you with an advantage but are currently losing the battle, it's about time you assessed your method and your psychology. This isn't a signal that you should change your strategy because you're on an unlucky streak. You might not have a problem in your trading method. Be objective about the aspects of trading. View the best backtesting for site examples including is crypto app legit, cryptocurrency app zebpay, best app to buy bitcoin in jamaica, bitcoin app australia, crypto app 2021, mining bitcoin app, crypto app download, download local bitcoin app, blockchain app keeps crashing, number 1 crypto app, and more.

Can I Trade Using Divergence?

Divergence in trading, as a summary, can be a useful option to add to your trading strategies in particular if you use indicators such as RSI and MACD to determine overbought and oversold levels. But, it must not be resolved by itself. It requires practice to learn. |

|